Embrace the Ides of July

By Eric Parnell, CFA on

The U.S. stock market is on the retreat. After peaking in the middle of July at 5669 on the S&P 500, U.S. stocks have fallen by as much as -5%. How much further should we expect the market to decline in the coming weeks, and is this recent weakness a cause for concern as we continue through the second half of 2024.

Healthy. The first key point to emphasize is that short-term stock market corrections are a healthy part of longer term bull markets. Stocks do not move in either direction in a straight line, but instead typically oscillate in a “two steps forward, one step back” manner for an extended period. And following a phenomenal run dating back to last October and more recently since mid-April with notably low price volatility, U.S. stocks have been long overdue for some sort of pullback. As a result, the recent weakness since mid-July should come as no surprise, as it shows that investor willingness to take some gains off the table as they load up for the next move to the upside.

Retreat. Nonetheless, today’s market is in retreat. Although it has fallen as much as -5% since mid-July, it remains solidly above its lows from July 25 through Thursday’s close. Perhaps more importantly, the S&P 500 continues to hold support at its medium-term 50-day moving average (blue line in the chart below), which is a constructive sign in support of the idea that any current market pullback may be short lived.

With that said, some notable short-term challenges remain for the market to overcome before making its next charge to the upside.

First, with its recent decline, the S&P 500 has broken below its upward sloping trendline dating back to Halloween. It has only been a recent and modest trend break so far, however, and the market is showing resilience in working to regain this support level.

Next, the S&P 500 broke decisively below its short-term 20-day moving average (dotted green line in the chart below) back on July 24 and has remained stuck below this level in the seven trading days since. Breaking back above this short-term resistance currently around 5538 on the S&P 500 will be key in resuming the advance to the upside.

Charge. Amid these signs of short-term weakness and consolidation are arguably greater causes for constructive optimism. Consider some of the following.

First, inflation expectations remain fully in check, market liquidity conditions remain favorable, and investors continue to exhibit risk tolerance, which are all favorable signals for a continued market advance in the months ahead.

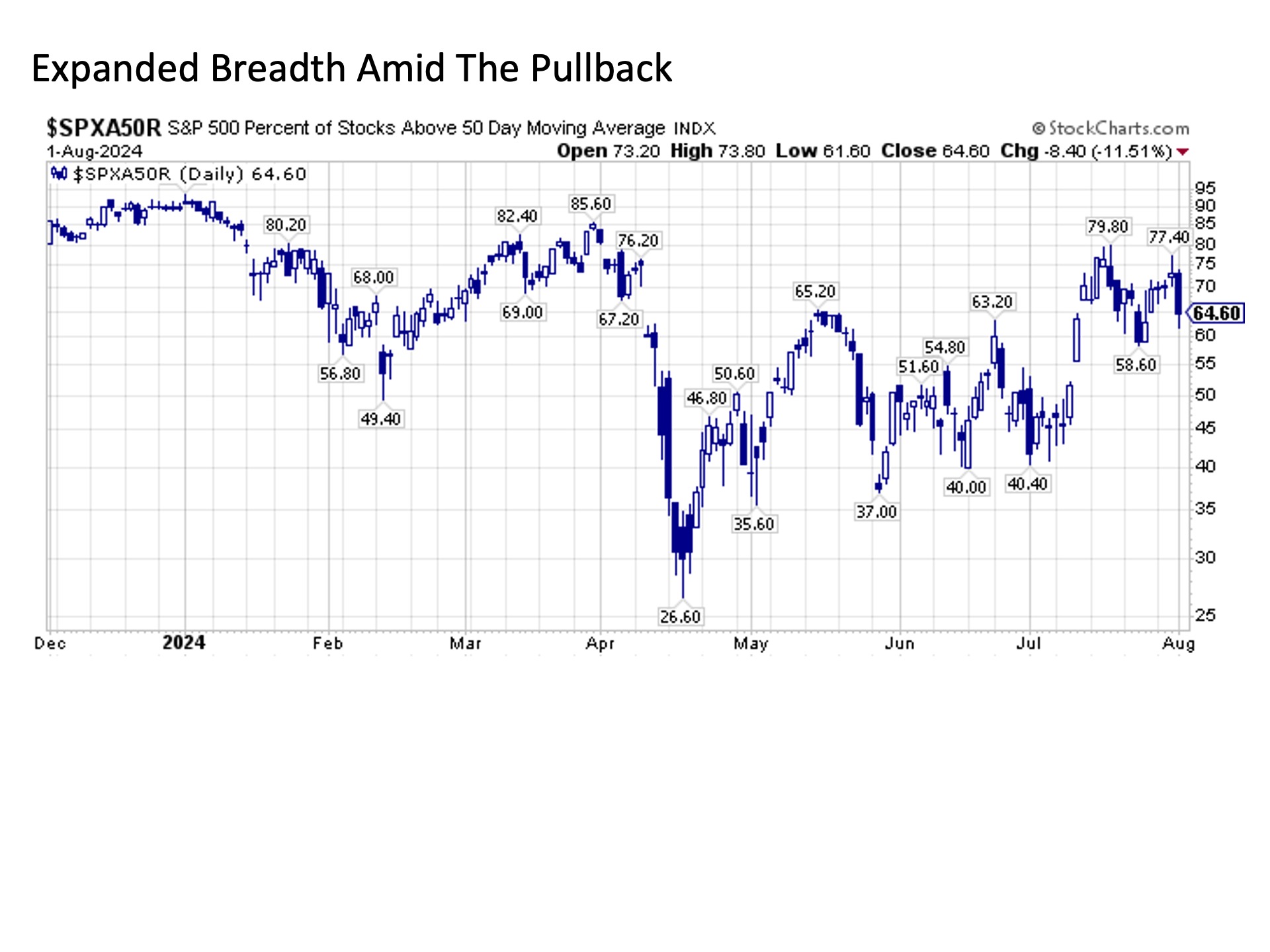

Second, markets are maintaining meaningfully increased breadth despite pulling back in recent weeks. A primary concern associated with the market advance particularly since mid-April was the extreme concentration. By early July, only 40% of stocks in the S&P 500 were trading above their 50-day moving average and only 21% of stocks were outperforming the headline index despite U.S. stocks trading at all-time highs. Put simply, this is extraordinarily narrow concentration for a market in such a strong advance. Despite falling back by as much as -5% in recent weeks, between two-thirds and three-fourths of stocks on the S&P 500 are now trading above their respective 50-day moving averages and more than 35% of stocks are now outperforming the S&P 500 index. This is a meaningful and healthy broadening of market performance in recent weeks, which is positive.

Third, the corporate earnings outlook has actually improved as we make our way through the second half of second quarter earnings season. Earnings growth on the S&P 500 is now set to increase by more than +10% on an annualized year-over-year basis through the remainder of 2024, which is a measurable improvement from the high single digit earnings growth forecasts heading into earnings season. This bodes well for the longer term bull market to continue, as corporate earnings growth is a primary driver of stock market gains.

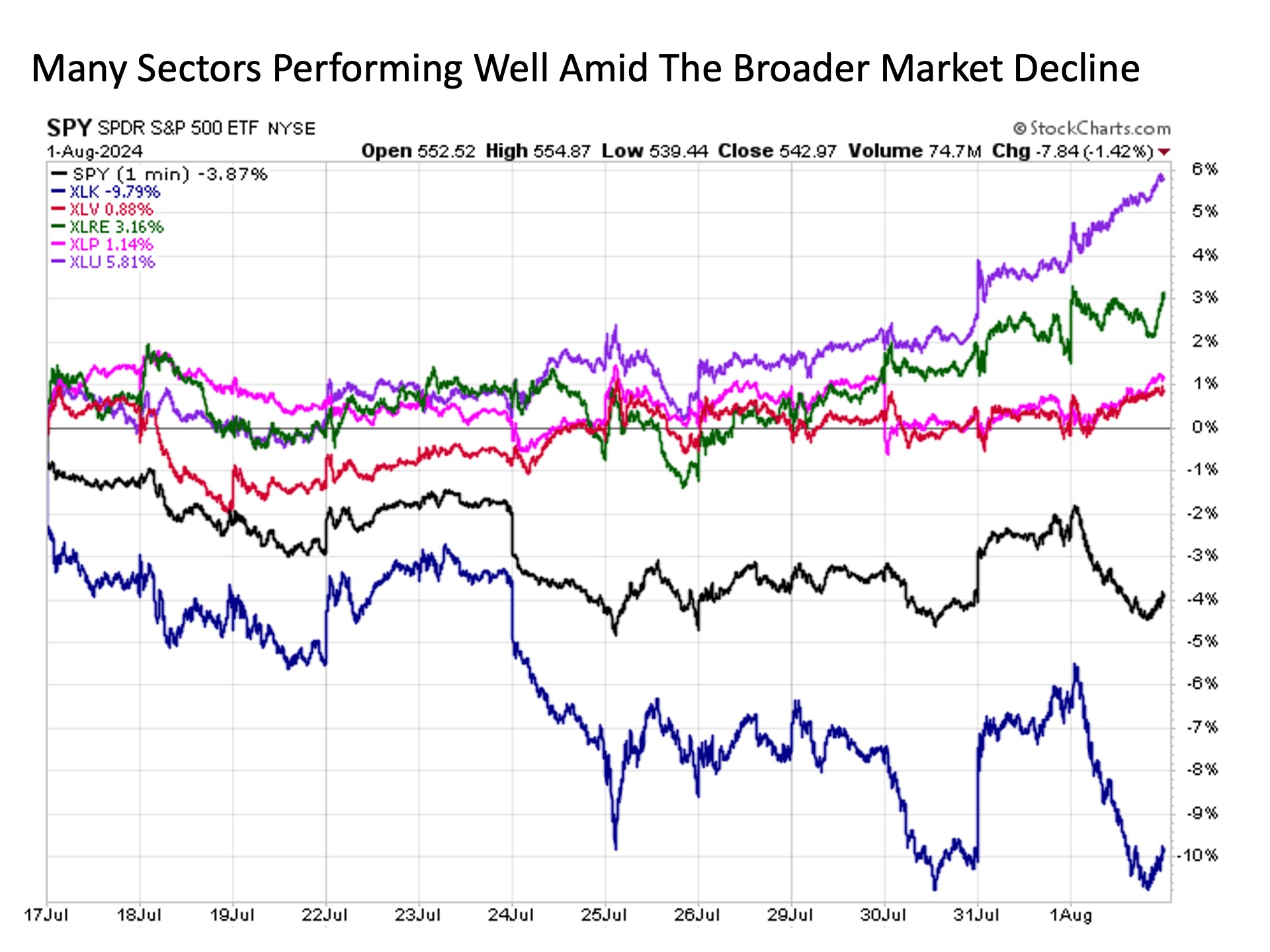

Lastly, just as stock market gains were highly concentrated in the technology sector during the spring and early summer, so too have stock market declines been concentrated in technology in recent weeks. For while the information technology sector at down -10% to date since July 16 has meaningfully underperformed the S&P 500 at -4%, many stock market sectors have scored solid gains over this same time period. This includes utilities up nearly +6%, real estate higher by more than +3%, and both consumer staples and health care higher by +1%. So even while the headline index may be lower, many segments within the index are moving higher, which is a positive sign.

Bottom line. Semiconductor stocks have fallen into correction over the past couple of weeks, which have pulled the broader market lower. This pullback may ultimately prove fleeting as it did back in April, but even if the chip dip becomes more prolonged, it’s important to remember that many market segments may continue to perform well underneath the surface.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 610826-1